Suburban Retail Continues to Out Perform Other CRE Assets

Published Expert Article

– by Keith Lenz

Associate Advisor at Pinnacle Real Estate Advisors

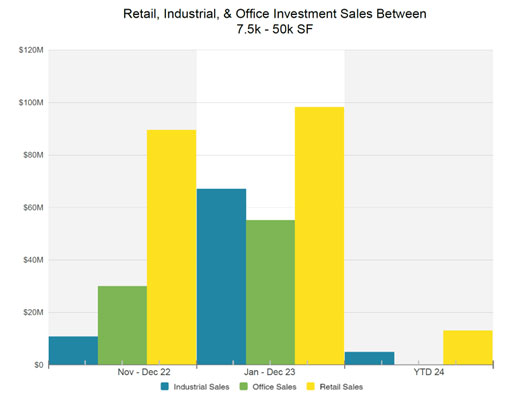

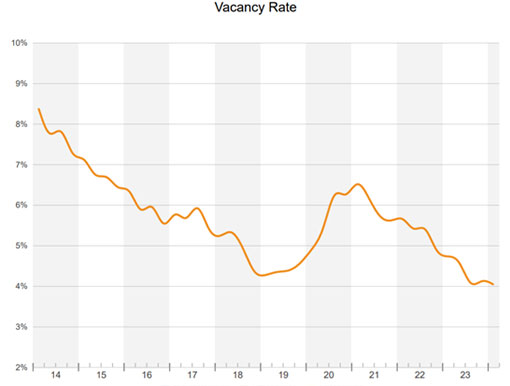

In November of 2022 I wrote an article about how suburban retail (multitenant retail located in the surrounding counties of Denver; Adams, Arapahoe, Broomfield, Douglas, and Jefferson) will be the next investment frontier. Since November of 2022 to present, multitenant retail investment sales totaled $201M. A whopping $118.4M more than the next highest trading asset class in terms of volume, which was Industrial (Multifamily was excluded from this comparison). Investors needed a new asset class to turn to that was going to produce higher returns and demonstrate a strong degree of safety. The writing was on the wall after Multifamily investment cap rates reached an all-time low in Q4 2022, industrial investment product lacked supply, and the general sentiment toward office investments was confirmed by the bank’s wariness to provide financing. Pair all of that with a 10-year low vacancy rate of suburban retail, and a large appetite for small business lending, and it created the perfect storm.

Signs point towards suburban retail continuing to outperform the other commercial asset classes for the next 18-24 months, but the strike point to purchase will be sooner rather than later…if it hasn’t already passed. Many investors have been on the sidelines waiting for “blood in the water” or distressed sales from the estimated $929 Billion of CRE debt that is ballooning this year, per Mortgage Bankers Association. However, this “feeding frenzy”, or “time to buy” does not seem likely to happen in the way that many investors expect.

Dr. Peter Linneman advised against this strategy in his last sit down with Willie Walker on the Walker Webcast and in his Linneman Letter. “There will be no grave dancing,” he said. This is because we all expect rate cuts this year, and if they happen to the degree that they are predicted, 100-150 basis points, then much of this debt will cover their loan conditions. Furthermore, the banks and owners are going to get creative and figure out ways to make it cover with this rate decrease.

The other reason that this “grave dancing” won’t happen is because of the sheer number of other investors that are waiting for the same thing. The distressed sales that do hit the market are likely going to have competition, and any sophisticated seller will price this in, or the competition will drive the higher price. It is also possible that opportunities like this will be scooped up by private capital before they hit the market. Investors waiting for the “perfect storm” may be wise to take a look at the current opportunities in front of them and consider striking before this pent-up competition shoots prices back up to where they were in 2021 and the first half of 2022. Trying to time the market rarely works out as hoped.

Vacancy rates for suburban retail have continued to decline. The current vacancy rate is 4.2% according to Costar, a new 10 year low. There is a lack of quality retail space in Colorado and a strong consumer base for these tenants searching for space which is driving up rents. Most of the tenants looking for space are still entertainment-based retailers. The worry of big box stores vacating shopping centers, such as Bed Bath and Beyond, has been mitigated by these entertainment retailers such as gyms, indoor pickleball, and golf simulator concepts.

Suburban retail is off to a hot start here in 2024 with nearly $20M in transaction volume. Currently cap rates for suburban multitenant retail have followed the trend of interest rates. According to Costar the average cap rate was 5.65% in 2022 and 6.92% in 2023. This number continues to go up and rates have also ticked down. Sub 6% interest rates are achievable as of today, but as interest rates fall, so will cap rates. Of course, industrial and multifamily are arguably the most popular product types today, but higher return opportunities for those assets may be further out. Colorado is underbuilt in industrial space and in single-family homes, driving up rental rates and driving down vacancies, which in turn inflates prices. The sweet spot for returns and lower risk currently lies in suburban retail.

Featured in the March 2024 Edition of the Colorado Real Estate Journal