Retail Market is Shifting: Suburbs are Winning

Published Expert Article

– by Eric Diesch

Vice President at Pinnacle Real Estate Advisors

I don’t want to sound negative, but … Lately, this phrase has been reverberating through commercial real estate spaces everywhere. We are all looking for a sign of improvement, but as the days pass, it feels like the bad news is mounting. Another bank has failed. Downtown office tenants are clearing out. Getting a construction permit is akin to going on a quest for the Holy Grail. Colorado lawmakers are trying to socialize apartments. Transactions are down around 65% at all brokerage houses, and Denver’s lack of enforcement for flagrant open drug use and crime makes a stroll through the central business district feel like a scene out of Zombieland. It’s easy to be negative these days, but as my good friend and one of the top brokers in the country always says, “You’ve got to be a good news guy on a bad news day!” So folks, here’s the good news! Colorado, like many other parts of the country, is in a period of transition. This shift will create exciting new retail trends, problems to solve and opportunities for those prepared for the cycle.

Many of you reading this know I grew up in Pittsburgh, a place that was once a business epicenter. Andrew Carnegie pumped out steel at the mills in Bethlehem, Pennsylvania, and built one of the largest global business empires. During the decades U.S. Steel operated, wars were fought and labor unionized, but the company continued to grow, and the city grew along with it. In the 1970s, this all began to change. The markets were suffering due to rapid inflation. The labor cost shifted quickly, and businesses began to off-shore their product, which ultimately led to the decline of both U.S. Steel and the city.

Over the next 50 years, Pittsburgh transitioned. The suburbs grew, and today Pittsburgh is alive and well. While the weather sucks, it is ranked one of the top 10 cities in the country to live in by Livability.com, which, candidly, surprises me. Sadly though, from what I see and hear today from friends in and out of the real estate business, there are a lot of sobering similarities between Pittsburgh’s decline in the ’70s and Denver’s current state.

Redfin.com recently announced that Denver lost 2,700 people in the fourth quarter of 2022. Many people cite affordability as one of the top reasons for leaving, and I would be willing to bet many of these people are moving to the suburbs. While the reasons may vary for this migration, the sobering truth is that more people are working from home now, and the thrill of being in a bustling city is no longer a key driver of motivation. Further, vacancy rates are climbing.

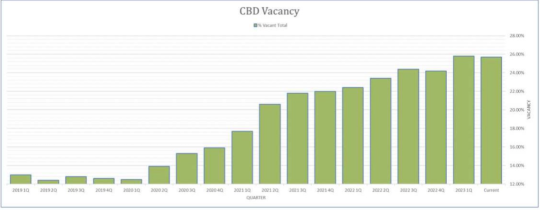

Over the past four years vacancy has climbed in the CBD substantially, with CoStar recording rates as low as 13% pre-pandemic to as high as 25% for the last quarter.

I believe this is very, very good for suburban retail. Working from home allows people to have more time and lower personal expenses. Businesses can reduce their overhead, which helps them remain healthy. This shift is obviously bad for the city and horrible for office product, but again, this is good for retail. Further, this population shift has resulted in people having more expendable income and more time to spend it. Traditionally, daytime populations are low in the suburbs, but telework has increased demand for more high-quality services, restaurants and shops. Business people are still going to go out for coffee, lunch and drinks to network; run errands; and meet friends after work for dinner.

While these migration patterns are evident in the data and daily life, identifying the opportunity is hard, and capitalizing on the opportunity is even harder. While none of us has a crystal ball, we all know that finding capital is not easy right now. Couple the lack of liquidity with nearly every Wall Street chief information officer or economist forecasting a recession in the next six to 12 months, and it gets scary to think about deals; but price discovery is starting to occur, and assets are starting to slowly get cheaper. Insurance companies are using this as an opportunity to load up on loans, and, right now, they like retail and are offering competitive terms. Investors reading: Price discovery is occurring and we are starting to see cap rates begin to increase for good product. Eventually, those with cash or access to capital will be able to buy retail product without heavy competition. Developers: Safe, business-friendly, suburban cities are continuing to grow. Johnstown, Erie and Firestone are prime examples. If you haven’t been to these towns recently, you should check them out. I think you would be surprised to see the activity.

Further, if you talk to any retail leasing broker today, he will tell you that he “can’t find space” or is “running out of space to lease.” The demand destruction for shopping centers from the 2008 financial crisis put a huge damper on new product during the recovery. No one wanted to build a strip center 10 years ago; it was too risky. Now, the barrier to entry is too great due to construction costs and lead times – the numbers rarely pencil. And again, this is the “good” news. Demand is far exceeding the supply, and if we do have a macro correction in the market, one would hope that tenant demand would offset defaults landlords would experience in their rent rolls.

I am sure many of you disagree with my comparison of Pittsburgh and Denver, but the truth is, Denver is in a natural process that every major city has gone through. These trends take decades to counterbalance and almost always require towns to hit rock bottom before they see improvement. If you think you are going to fight this trend using traditional tactics, good luck. I know I’ll spend my time with shopping centers in the suburbs.