Federal Reserve Signaling Rate Cuts May Result in Value Decline

Published Expert Article

– by Kenny Clarke

Associate Advisor – Pinnacle Real Estate Advisors

Today’s market is challenging for both buyers and sellers of commercial real estate assets. Over the last two years, we’ve seen an increasing bid/ask spread and declining valuations. Now, as the Federal Reserve signals interest rate cuts, some owners feel optimistic that their asset values and equity positions should improve. After all, when debt was cheap, pricing was high, and thus we should theoretically see a competitive buying environment once again. The truth, in fact, is that the ramifications of rate cuts extend beyond mere the cost of capital, and instead deserve a more comprehensive understanding of our local market dynamics.

One of the prevailing challenges facing the real estate market since the beginning of the rate hikes in 2022 is the rising cost of capital. Transaction volume took a huge hit and we’re still experiencing the results. Now, with signals of rate cuts, optimism persists that capital should become more affordable and readily available. Instead, what we believe is that our forward-looking market already includes potential short-term rate cuts baked into our borrowing costs. Generally speaking, even more cuts than the Fed has signaled are already priced in. The outlier is a recession. This would likely result in rate cuts of a substantial size that will make a difference in the longer end of the curve and our 5/7/10 year treasuries. This would force the Fed to re-evaluate their policy, which as of now is still beating inflation down to 2-2.5%. It’s been multiple years since we’ve broken the 3% inflation floor and with positive employment numbers, inflation will remain the Fed’s priority and thus will probably keep rates restricted.

A soft landing is where we’re headed (or being told), so effectively, the cost of capital should remain mostly steady, and a conservative estimate of around 25 basis points plus or minus by year end. We’re still digging out of negative leverage pricing and although we’re close, we simply aren’t there yet. And while the cost of capital remains a cornerstone in determining property values, several other local factors more recently contribute at a greater level. I’m referring to what we all already know – new apartment supply in 2024 and 2025, higher vacancy, slowing rent growth, absurd operating costs, new legislation and a general lack of depth in the buyer pools. It’s my opinion that these other factors will continue to weigh heavily on buyer underwriting and will persist as an anchor to asset values, working in tandem with a steady cost of capital still significantly higher than we saw in 2020 and 2021.

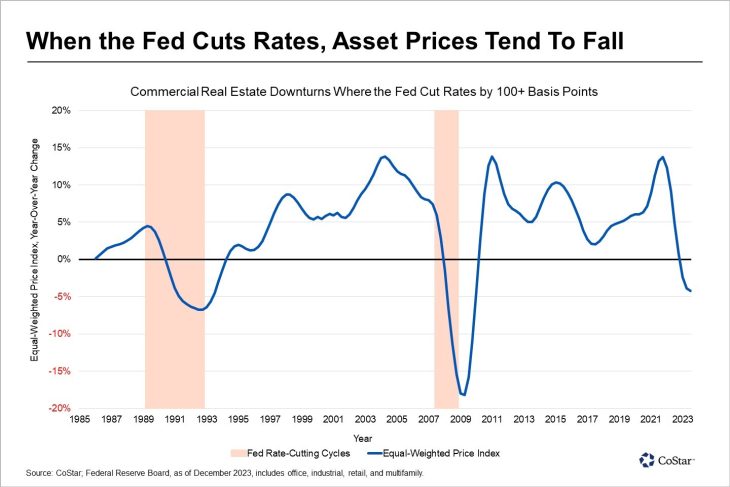

Rate cuts signal an expected cooling in economic growth. When we saw economic cooling in the early 1990’s and late 2000’s, we saw vacancy rates rise and asset prices fall. There is evidence to suggest that as we hover over our concerns, we’ll see similar impacts to our market. Economic cooling will result in greater impacts to net income preservation. The factors mentioned earlier, like supply and vacancy, working together with slowing rent growth, operating expenses, and costly legislation will negatively impact NOI growth. If we see NOI’s decline and our current borrowing costs stay consistent, it’s a recipe for declining values. So while operators focus on preserving net income, values will continue to deteriorate. Those who have owned a long time or are experiencing positive growth and occupancy have the opportunity now to evaluate the risks of holding longer. While our current buyer pools remain small, some groups remain with capital investment requirements and are capable of closing on deals with positive yield. It’s those properties, with successful operating histories, that are primed for monetization.

On the operations side, amidst these challenges, opportunities for strategic navigation present themselves. Investors and property owners must adopt a disciplined and focused approach, recognizing the shifting dynamics and adapting their operating strategies to preserve their net income. Now more than ever is a time to consider your management options, income-generating and cost-saving measures and overall building compliance so that as our market shifts downward you are adequately prepared to position your assets and capture your equity while others battle negotiations and sink or swim with their cash flows and coverage restraints.

While we anticipate declining asset values, many will choose to ignore the challenges and wait for the next upturn. However it’s now more than ever that investors should stay plugged in to advisory sources and take advantage of their windows of opportunity when they present themselves. Owners without debt can avoid the general cost of capital conversation altogether by selling and acting as the bank, carrying a new mortgage for a buyer. Owners with long-term fixed rate debt will have their own options to consider. In general, it’s my belief that those that are willing to discuss their challenges openly will succeed in finding the most creative solutions to their problems.”

Featured in CREJ’s February 2024 Multifamily Properties Quarterly