Good Deals May be on the Horizon for Retail Buyers

Published Expert Article

– by Eric Diesch

Vice President at Pinnacle Real Estate Advisors

I was talking with a friend who happens to run retail acquisition teams across the country this week. I spoke with him about writing this article, and he joked, “You should write about when we are finally going to start seeing the good deals!” For those new to the industry, the “good deals” he refers to are distressed assets bought from banks or owners at extreme discounts due to external pressures like rising debt costs and a declining NOI. I took out my crystal ball and asked it to tell me when we would see the good deals and the damn thing didn’t say anything back—must be broken again!

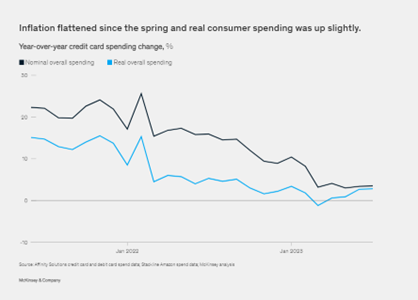

Since starting my career in leasing, I have often looked at the activity and viability of the tenants in the marketplace as a harbinger. Tenants are the foundation of investment real estate, and every tenant broker in town is struggling to find space for their clients. Vacancy on the Front Range is currently 4.3%, and rents are up 2.3% per Costar. Perhaps most importantly, consumer expectations are relatively flat, and as inflation has dipped a bit in Q3 2023, consumer spending has increased slightly, according to McKinsey & ‘Company’s October 5th report. As long as these patterns continue, they will fuel demand in the tenant sphere, and landlords will continue to operate their assets at or above historical leasing trends. This results in the possible scenario of a stunning retail stabilization in the face of high refinancing costs, causing property owners to hold on to their assets. Yet, nobody seems to be asking, “What happens if consumer demand falls and tenants slow or stop expansion”?” I believe this is not a question of “if” but ” when.”

Everyone who has taken Econ 101 knows the saying, “You ‘can’t fight the Fed.”” Jerome Powell has been clear that he is on a mission to bring inflation to 2%, with progress being measured by increased unemployment and reduced consumer spending. The data suggests we are losing ground on the mission due to static low unemployment rates, continued consumer spending, and GDP growth. We are beginning to see some red flags with the consumer. Credit card balances are at an all-time high, student loan payments are resuming at an average of roughly $300 per month, and as of October 21st, 2023, subprime auto loan delinquencies are at a record high, according to Business Insider. While these red flags are insufficient to justify the Federal Reserve changing its “higher for longer” mandate, it will eventually impact the population’s spending habits. Jerome Powell has said, “Inflation is still too high, and lower economic growth is likely needed to bring it down.” As the benchmark rate increases and student loans negatively impact consumers, we should see purchasing power decrease, especially among the coveted millennial demographic. The business implications of inevitable consumer spending deceleration are what scare me most.

I have reviewed the financials of a lot of “mom and pop” and franchise operators over the years. I can tell you they don’t have the staying power for another downcycle. Many of these businesses started with a shoestring budget, but even if they were flush with cash initially, COVID-related economic impacts and rising operating costs have depleted many of their cash reserves. A notable amount of tenants are struggling to stay afloat. The lack of cash and increased debt costs significantly increased vacancy for class B & C shopping centers market-wide.

While many people in the retail world have been happy or even surprised with the resiliency of their tenant base, it is pretty clear there is a storm brewing for owners. My suggestions for clients in the marketplace are simple:

1. If you have a vacancy, get it leased up. It is easier to work through a downturn with tenants than to try to find them when business isn’t growing.

2. Invest in your property. Most of the centers in the B & C categories need a facelift: Clean up the landscaping and prepare to stand out to the active tenants looking to relocate or open new businesses.

3. Invest in your tenants. Have a new Jr. box or box tenant? Work with them to have a grand opening. Get everyone involved so they can participate in advertising and promotion.

4. Security. Have a problem with crime? People experiencing homelessness? Get on-site security.

5. Debt. If you have debt maturing in the next 24 months, consider selling to free up cash.

There will be many owners out there who don’t subscribe to the issues we are facing. Many of them will not take a defensive strategy to combat the environment, and these owners will have increasing pressure to sell as time progresses and debt maturities increase. At this point, we just might begin to see the “good deals.”

Featured in CREJ’s November 2023 Retail Properties Quarterly